Selling Your Data: An Introduction to Data Brokers

The data broker ecosystem is thriving thanks to the ever-increasing use of technology and the internet.

The data broker ecosystem is thriving thanks to the ever-increasing use of technology and the internet. As a result, issues related to privacy and cyber security have become more critical than ever. Data brokers collect, analyze, and sell personal information to various entities, making it essential for individuals and businesses to understand the data broker ecosystem and take necessary steps to protect their privacy. In this introduction to data brokers, we will break down the data broker ecosystem and discuss the importance of privacy solutions like 360 Privacy.

Introduction to Data Brokers

Data brokers are companies that collect, analyze, and sell personal information about individuals to other organizations. These companies gather data from various sources, such as public records, social media profiles, online transactions, and more. They then use this information for various purposes, including marketing, fraud detection, risk mitigation, and people search services.

As the demand for personal information increases, the data brokerage industry has become a lucrative business. According to WebFX, there were over 4,000 data brokerage companies operating worldwide in 2019, generating billions of dollars in revenue. With privacy concerns on the rise, it’s crucial to understand how data brokers operate and how privacy-focused solutions (like 360 Privacy) can help protect your personal information.

Types of Information Collected by Data Brokers

Data brokers collect a wide range of information about individuals, from basic demographic data to more detailed and sensitive information. Some examples of the types of information collected by data brokers include:

- Name, address, and contact information

- Birthdate, gender, and marital status

- Employment history and job title

- Income and financial information

- Credit history and credit scores

- Social media activity and online behavior

- Hobbies and interests

- Shopping habits and purchase history

- Public records, such as court records, property records, and voter registration

This extensive collection of data enables data brokers to create detailed profiles of individuals, which can then be sold to other organizations for various purposes.

How Data Brokers Collect Information

Data brokers gather information from various sources, both online and offline. Some common methods of data collection include:

- Public records: Collected information from public records, such as court records, property records, marriage and divorce records, voter registration information, and more.

- Social media and online activity: Data from social media profiles, online forums, blogs, and other websites where individuals share personal information.

- Online transactions: Information from online retailers, credit card companies, and other businesses about individuals’ shopping habits and purchase history.

- Loyalty programs and surveys: Loyalty programs, surveys, and sweepstakes that individuals participate in.

- Data-sharing agreements: Data brokers often purchase or exchange data with other organizations, such as credit bureaus, insurance companies, and other data brokers.

- Consumer Purchases: Vehicle purchases and cellular network subscriptions are among the least private transactions that consumers purchase.

Uses of Personal Information by Data Brokers

Data brokers sell the information they collect to other organizations for various purposes. Some common uses of personal information by data brokers include:

Marketing and Advertising

The world of marketing and advertising has dramatically changed over the last few decades. With the rise of the internet and big data, businesses can now collect vast amounts of personal information about their customers, including their preferences, interests, and shopping habits. This information is often obtained through data brokers, who collect information from various sources and then sell it to businesses that use it to create targeted marketing campaigns.

On the surface, this may seem like a harmless practice – after all, who doesn’t want to receive ads and offers that are tailored to their interests and needs? However, the reality is that the use of personal information for marketing purposes can be highly invasive and unsettling. Many individuals are uncomfortable with the idea that their personal data is being bought and sold without their consent.

Furthermore, the use of personal information for marketing purposes is not always transparent. Businesses may use subtle or even deceptive tactics to collect personal data from their customers, such as through tracking cookies or by offering free services in exchange for personal information. This lack of transparency can erode trust between businesses and their customers and can even lead to legal issues if businesses are found to be using personal data in unethical ways.

Fraud Detection and Risk Mitigation

Personal data has become an essential tool for organizations such as banks, credit card companies, and insurance providers. By analyzing individuals’ personal information, these organizations can assess risk, detect and prevent fraud, and make informed decisions about lending or providing coverage. However, the use of personal data for these purposes can also put individuals’ privacy at risk.

One of the most common ways that organizations use personal data is to detect and prevent fraud. Fraud can take many forms, from identity theft to credit card fraud, and can result in significant financial losses for both individuals and organizations. By analyzing personal data from data brokers, organizations can identify patterns and anomalies that may indicate fraudulent activity.

Another way that organizations use personal data is to assess risk. For example, insurance companies may use personal data to determine the likelihood of a customer making a claim, while lenders might use personal data to determine the creditworthiness of a borrower. By analyzing personal data, organizations can make more accurate risk assessments and make better-informed decisions about lending or providing coverage.

In addition, personal data can be used to verify the accuracy of loan applications. Lenders may use data broker information to verify an applicant’s income, employment history, and other financial details. This information can be used to determine whether an applicant is a good credit risk and can help lenders avoid loan defaults.

However, the use of personal data for these purposes can also put individuals’ privacy at risk. Organizations collect and store large amounts of personal data, including sensitive information such as Social Security numbers and financial information. This data can be vulnerable to data breaches and other security incidents, which can result in identity theft and other forms of fraud.

People Search Services

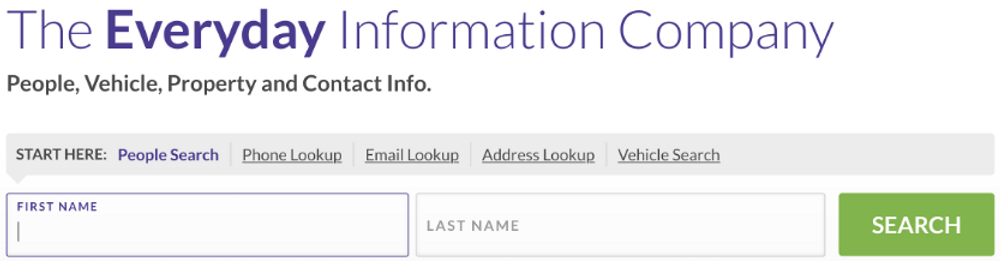

In today’s digital age, the internet has made it easier than ever for individuals to find information about others. People search websites are one such platform that allows users to find contact information, addresses, and other details about individuals for a fee. However, the data used by these sites often comes from data brokers.

Data brokers collect personal data from a variety of sources, including public records, social media, and online activity. This information is then sold to people search websites, which can use it to create detailed profiles on individuals. These profiles can include information such as phone numbers, email addresses, and even criminal records.

While people search websites can be useful for finding lost friends or reconnecting with family members, they can also be used for more nefarious purposes. For example, scammers may use people search websites to find personal information on their targets, which they can then use to create more convincing phishing emails or scam phone calls.

Criminal Use of People Search Services and Data Brokers

Hackers and cyber criminals are known to exploit any opportunity to gain access to personal information, and people search sites and data brokers are no exception. They can use the personal information available on these sites to carry out various types of attacks, such as phishing, social engineering, and identity theft.

Phishing attacks are a common tactic used by hackers to trick individuals into providing sensitive information, such as passwords or credit card numbers. Hackers can use information from people search sites to create highly targeted phishing emails that appear to come from a trusted source. For example, they can use a person’s name, location, or occupation to craft a convincing email that appears to be from a bank, credit card company, or employer.

Social engineering is another tactic that hackers use to gain access to personal information. In this type of attack, hackers use psychological manipulation to trick individuals into divulging sensitive information or taking an action that benefits the hacker. People search sites can provide valuable information that hackers can use to build trust with their targets and make their social engineering attacks more convincing.

Identity theft is also a significant risk associated with people search sites and data brokers. Hackers can use personal information available on these sites to create fake identities or impersonate someone else online. They can use this information to open credit accounts, apply for loans, or even file fraudulent tax returns.

Furthermore, data breaches and other security incidents can also result in sensitive personal information being leaked online, including data obtained from people search sites and data brokers. This information can then be sold on the dark web or used to carry out further attacks.

To protect against these threats, it’s important for individuals to be vigilant about their personal information and take steps to protect their privacy. This includes being cautious about sharing personal information online, using strong and unique passwords, and regularly monitoring credit reports for any signs of fraud or suspicious activity.

Legal and Regulatory Landscape for Data Brokers

While data brokering is not illegal in most countries, some states and regions have implemented laws and regulations to protect consumer privacy and regulate the data brokerage industry. For example:

- Vermont passed a law in 2018 requiring data brokers to register with the state and disclose their data collection practices. https://ago.vermont.gov/blog/2017/12/05/data-brokers

- California’s Consumer Privacy Act (CCPA) allows residents to request copies of their personal information held by data brokers, request deletion of their data, and opt-out of having their data sold. https://oag.ca.gov/privacy/ccpa

- New York is considering a bill that would require data brokers to register with the state and provide information about their data collection practices.

In the European Union, the General Data Protection Regulation (GDPR) imposes strict rules on data collection, processing, and sharing, offering significant privacy protections for individuals.

Protecting Your Privacy in the Data Broker Ecosystem

While it may be challenging to prevent data brokers from collecting your personal information entirely, there are several steps you can take to reduce your exposure and protect your privacy:

- Be cautious about the information you share online, especially on social media and other public platforms.

- Limit the information you share with stores, online and offline. Retail reward programs are notorious for sharing customer profile information with the marketing and data broker ecosystems.

- Use privacy-focused tools and services, such as 360 Privacy, to help protect your personal information and reduce your exposure to data brokers.

- Opt-out of marketing and data-sharing programs whenever possible.

- Use a VPN or the Tor browser to hide your online activity and protect your data from being collected by data brokers.

360 Privacy: A Comprehensive Solution for Protecting Your Privacy

360 Privacy is a leading privacy solution that helps individuals and businesses reduce their exposure to data brokers and protect their personal information. With proprietary technology and an expert team, 360 Privacy offers a comprehensive approach to privacy protection, making it the industry leader in Digital Executive Protection.

By partnering with 360 Privacy, you can take control of your personal information and safeguard your privacy in the data broker ecosystem. To learn more about 360 Privacy and how it can help protect your privacy, visit 360privacy.io.